Nigerian digital banking startup, Brass has been acquired by a group backed by Nigeria’s fintech giant, Paystack in a bid to address liquidity issues that threaten to shut down the firm.

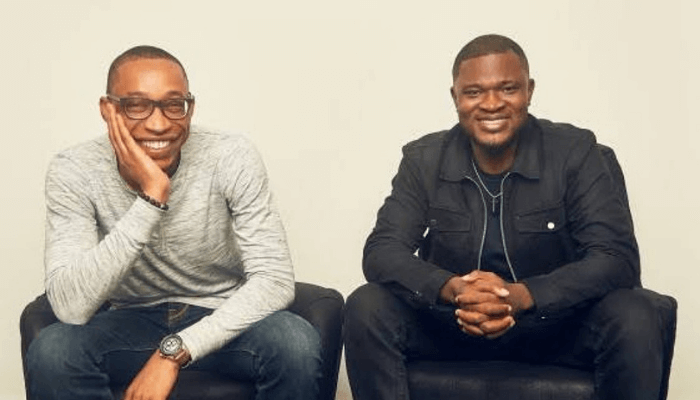

With Brass, Sola Akindolu and Emmanuel Okeke, who founded the company in July 2020, target to provide SMEs with a full-stack, commercial-grade banking service across the different classes of business to help them have more control over their money operations and the ability to scale their businesses.

Like any other startup, Brass has not been immune to the economic challenges around the globe under which it operates; liquidity constraints have compelled the firm to secure debt funding in an attempt to meet the withdrawals of its consumers. It has now been bought by a group of investors typified by Paystack, Piggytech, Ventures Platform as well as P1 Ventures respectively.

The assets and liabilities will transition to the consortium, and Akindolu and Okeke will exit the startup.

“Over the years, we have added and supported tens of thousands of businesses with top-end financial tools for local businesses, and we are just getting started. We have also had the incredible opportunity to build with some of the most brilliant and talented people we know.

“Following the acquisition, Brass will continue to build and support its customers and grow with a new leadership team, as the founding leadership team will leave to pursue other opportunities. The work of making entrepreneurship permission-less is far from finished, and we definitely look forward to what’s next from the new team.” he added.

COO of Paystack, Amandine Lobelle, stated that since the company’s establishment, Brass and Paystack had been closely working partners.

“We’re thrilled today to announce a new chapter in our partnership,” she said. “Each member of the investment group brings several years’ worth of experience financing and building reliable financial service products, and together with a new infusion of capital, we’re excited for Brass’ next stage of growth.”